The Meezan Bank Car Ijarah that is provided through Meezan Bank Car Ijarah is the first interest-free vehicle financing service in Pakistan. The product is an adaptation of what is known as the Islamic Financing mode of the Ijarah or leasing and is the ideal choice for those seeking an interest-free financing option to purchase an automobile.

For salaried employees, It is required to be employed for at least 3 months in the current job, and two consecutive years in employment. A businessperson should have 2 years of continuous business experience with shares or partnerships and their income must be higher than the rental per month. In both cases, the businessperson must be able to prove a clean data check and e-CIB with no outstanding or default.

Car Loan Offer of Meezan Bank 2022 Eligibility Criteria:

- There are a few requirements that all applicants must meet before applying for a loan for their car;

- The only cars you can apply for are our local assembly and Pakistani manufactured vehicles

- The security deposit or advance rental minimum 15% and up to 50percent of the price of the vehicle

- You are not in default or overdue

- The entire list of Roshan Bank Account holders are also eligible

- There are no processing fees

- Bank Installments must be paid every month

- Your car will be delivered to the co-borrower / nominee (blood family member – father or mother, son or daughter, brother or spouse or sister who lives within Pakistan) of the applicant

- You are eligible for an auto loan if you are is not over 70.

- Taxes added by 4% for non-taxpayers

Documents Required For Applying of Meezan Bank Car on Loan:

- Copy of CNIC

- Bank statement for 6 months

- Employment Certificate (In the case of an employee)

- Business Documentation (In the event of business of nominee)

- One passport size photograph

- Any utility bill that is paid (Electric/Gas/Water) was received at the address of the residence

- Complete application form

Required Documents:

For Salaried Individuals

- Latest employment certificate including the date of joining

- Last six-month credited salary bank statement

- Nominee CNIC copy

- Name of employer’s HR representative with the mailing address

- Credit Bureau Report of stay country

For Businessman

- Valid business proof

- Last six-month verified bank statement through the embassy

- Nominee CNIC copy

- Credit Bureau Report of stay country

- In case of remittances income, the last six months bank statement of the remitter would be required

Features & Benefits of Meezan Bank Auto Loan

It is the Meezan Bank Car Ijarah that provides the lowest upfront cost and you’ll make the rental payment following the vehicle is delivered. It provides quick processing times as trackers are fitted with no cost monitoring and installation. Health and death coverage for free of up to Rs.400,000 with a security deposit as that is as low as 15 15%. It is important to note that the With Holding tax on a vehicle purchase will be borne by the bank, not by the buyer.

Meezan Bank Car Ijarah is offering an interest-free Car Loan facility in Pakistan. It’s also known by the name of Meezan Bank Car Ijarah because the loan program operates under the Islamic financing model. The Meezan Bank Car Ijarah loan is a program to help with the financial needs of those who wish to purchase a vehicle with an installment loan from any bank, but don’t need to pay back the loan with fees. You can purchase locally made vehicles through bank loans.

If you have doubts about the concept. In this case, I’ll explain in plain English that if you request a loan for a car from one of the banks, you will be able to get the Meezan Bank will buy a vehicle with its own funds and loan it to the person who applied for the basis of a rental agreement for cars and you are required to make installment payments with intervals of 1 to five years.

Meezan Bank Also Finances Used Vehicles through Car Ijarah!

In addition to leasing new cars, Meezan Bank also provides the unique opportunity of leasing second-hand, both locally assembled and imported vehicles. This feature is specifically designed as a highly economical option. The Used Car Ijarah facility is made available at a minimum-security deposit as low as 30%.

Note: 15% security deposit will apply to locally manufactured or assembled vehicles of up to 1000 CC engine capacity.

How is Car Ijarah Shariah Compliant?

Car Ijarah, designed under the supervision of the Meezan Banks Shariah Supervisory Board is unique among car leasing services provided by other banks.

Liability and Rights of The Owner vs. User

The Islamic Ijarah is an asset-based contract, i.e. the Lessor must own the asset throughout the term that the agreement is in force. By Islamic Shariah, all ownership-related rights and obligations should be with the owner, while all rights and obligations related to usage should be the responsibility of the user. A traditional lease contract is not able to differentiate between their respective obligations and assigns all obligations to the owner of an asset.

This is contrary to Islamic Shariah. In the Islamic Shariah of Ijarah, the rest of the ownership-related risk with the Bank and all usage-related risks fall on the person who is using the asset, rendering the Lessor the sole beneficiary of an asset, and the revenue generated by the lease agreement permissible (Halal) to the Bank.

Continued Lease Rental in The Event of Total Loss or Theft of The Vehicle

If the vehicle leased is destroyed or stolen The traditional leasing company continues to charge rent of the lease until the payment of the insurance claim. According to the Islamic system, rent is considered to be a payment for the use of the asset leased, and if the asset is destroyed or stolen the idea of renting disappears. In the above scenarios, Meezan bank does not charge lease rent.

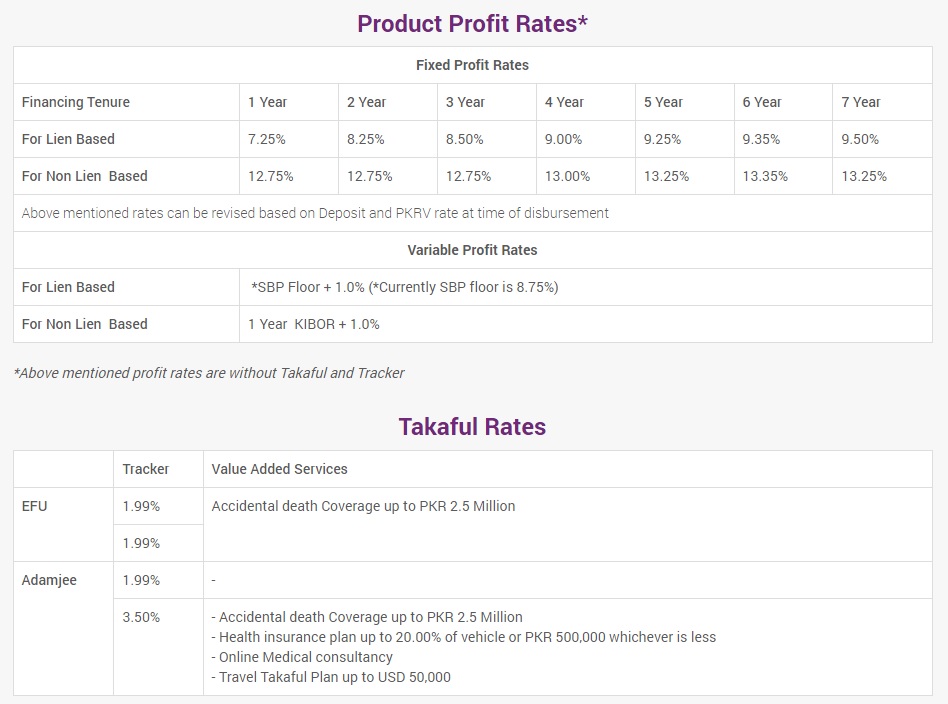

Takaful as an Alternative to Insurance

Legally (by the Pakistani Law and Regulations), it is the requirement for leasing companies to cover the leased assets. In this way, Meezan Bank ensures its leased assets. Meezan Bank insures its assets through Takaful exclusively which can be described as the Islamic product used for insurance.

Permissibility to Penalties for late payment of rent by Islamic Shariah

In the majority of modern financial leases, there is an additional amount of money that is added to their income, if the rental isn’t paid in time. The extra amount is known as Riba and is also known as Haram. In the context of Ijarah, the Lessee can be required to agree that in case he fails to pay rent by its due date, he’ll pay some amount to a charitable organization that will be administered by the Islamic Bank. In this regard, the bank will maintain an account for charity where amounts can be credited and distributed for charitable purposes.

Required Documents

- Application form duly filled and signed by the applicant

- Copy of recent payslip/certificate showing – For Salaried individuals.

- Business Proof – such as bank certificate confirming proprietorship, NTN, business Association letter or tax return, etc. is required – For businessmen.

- Copy of last six months bank statements

- One recent photograph.

- Specimen Signature card preferably on bank’s prescribed format

Registered Office & Head Office

Meezan Bank Limited

Phone: +92 (21) 38103500 & +92 (21) 37133500

Meezan Bank Guarantee Verification

Name: Naheed Ashfaq

Contact: + 92 (21) 38103500 Ext: 3558

Name: Syed Salman Nadeem

Contact: + 92 (21) 38103500 Ext: 2157

Call Centre

+92 (21) 111-331-331 & +92 (21) 111-331-332

Customer Care Unit

To record your complaint, please use the following channels:

24/7 Call Center : +92 (21) 111-331-331 & +92 (21) 111-331-332